Selection of Machine Tools — A Foundational Investment for Enterprise Production Capacity

The average lifespan of a numerically controlled machine tool reaches 15 to 20 years, and the decision to purchase one often impacts a company's manufacturing capacity for the next decade. The global CNC machine tool market is projected to reach US$100 billion by 2024. Faced with hundreds of brands and thousands of models, how should procurement officers make prudent decisions amidst such complexity? Industry research indicates that 65.11% of enterprises experience decision-making errors of varying degrees in machine tool procurement, resulting in an average loss of 23.11% in expected value. This paper adopts a practical perspective to analyse five core selection criteria in detail and provides objective comparisons of major brands, thereby assisting enterprises in establishing a scientific machine tool procurement decision-making framework.

Part One: Precision Performance Metrics — Practical Considerations Beyond Nominal Data

1.1 Positioning Accuracy and Repeatability

Interpretation of International Standards

ISO 230-2 Specification: International Standard for Acceptance Inspection of Machine Tools

Test method: Full-length measurement using a laser interferometer, with corrected data at one-metre intervals

Industry benchmark values:

Conventional machine tools: Positioning accuracy ±0.01 mm, repeat positioning accuracy ±0.005 mm

Precision machine tools: Positioning accuracy ±0.003 mm, repeat positioning accuracy ±0.0015 mm

Ultra-precision machine tools: Positioning accuracy within ±0.001mm

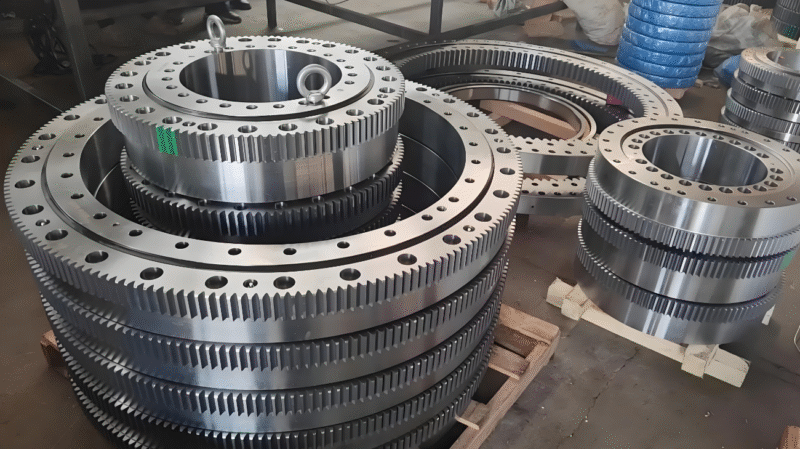

Practical considerations![图片[1]-CNC工作機械購入時に考慮すべき5つの重要指標とブランド比較-大連富泓機械有限公司](https://jpdlfh.com/wp-content/uploads/2025/12/QQ20251102-193830-1-800x489.png)

Temperature effect: While nominal accuracy is typically obtained at a constant temperature of 20°C, variations arising from temperature differences of ±2°C (approximately 0.002 mm/m) must be considered in actual working environments.

Consistency throughout the entire travel: Focusing on the precision deviation at both ends of the travel, high-quality machine tools should maintain a deviation of no more than 150% relative to the nominal value.

Long-term stability: Accuracy decay within six months should be less than 201 TP3T.

Test proposal:

Require suppliers to provide third-party inspection reports

Field machining tests on ISO specification test pieces (e.g., NAS 979 test pieces)

Testing of Accuracy Retention under Different Load Conditions

1.2 Geometric Accuracy and Dynamic Accuracy

Principal geometric error terms:

True straightness: ≤0.008 mm/m within the XY plane (Precision grade)

Verticality: Verticality between shafts ≤ 0.008 mm/500 mm

Radial runout of the spindle: ≤0.003 mm (near end), ≤0.006 mm (at 300 mm)

Dynamic precision performance:

True roundness test: True roundness of ∅100mm in machined condition ≤0.01mm

Contour accuracy: Actual contour error in complex surface machining

High-speed precision: Accuracy degradation when tested at 80% of maximum speed

Case Comparison:

An automotive mould manufacturer tested three brands of machine tools of the same specification:

Brand A (Germany): Dynamic roundness 0.008mm, price 2.8 million yuan

Brand B (Japan): Dynamic roundness 0.012mm, price ¥1.9 million

Brand C (Taiwan): Dynamic roundness 0.018mm, price 1.2 million yuan

Final decision: Purchase one unit of Brand A for precision machining and three units of Brand C for rough machining, thereby achieving a balance between precision and cost.

Part Two: Rigidity, Power and Thermal Stability

2.1 Structural Rigidity Analysis

Bed Frame Structural Design:

Material selection:

Cast iron: A traditional choice, offering excellent damping properties (HT300 and above)

Polymer concrete: An emerging material with a vibration damping ratio 6 to 10 times higher than cast iron.

Steel plate welding: Lightweight design, suitable for high-speed machine tools

Structural Optimisation: Through finite element analysis-based optimisation of rib placement, the top brand achieves a stiffness-to-weight ratio 30-50% higher than that of general brands.

Spindle system rigidity:

Spindle tip displacement: Deformation under rated cutting force

Typical values: Hard-rail machine tools ≤0.015mm, Linear guide high-speed machine tools ≤0.025mm

Test method: Apply radial force and measure displacement using a micrometer.

Guide rail and ball screw configuration:

Hard rails vs linear rails: Hard rails possess 3 to 5 times the load-bearing capacity, whilst linear rails achieve 2 to 3 times the speed.

Lead screw diameter: ∅40mm and above are heavy-duty cutting specifications.

Preload adjustment: Clearance elimination via double-nut preload

2.2 Detailed Evaluation of Spindle Performance

Output and Torque Curve:

Fixed power range: A wide range (e.g., 1:8) is preferable to a narrow range.

Maximum torque: Focus on torque in the low-rev range, for example the torque value at 200 rpm.

Overload capacity: Short-term overload capacity (e.g. 150%, 30 minutes)

Selection of Spindle Type:

Gear-driven spindle: Capable of high torque and heavy-duty cutting, though maximum rotational speed is restricted (typically ≤6000 rpm).

Direct-drive electric spindle: High rotational speed (12,000–40,000 rpm), high precision, but torque is comparatively low.

Hybrid spindle: Achieves both high-speed rotation and high torque through a two-stage design.

Cooling and Thermal Management:

Spindle oil cooling: Temperature control accuracy ±1°C

Automatic adjustment of bearing preload: Reducing the effects of thermal expansion

Thermal Symmetry Design: Reducing Spindle Tilt

Actual performance data comparison:

Brand/Model Output (kW) Maximum Torque (Nm) RPM Range Rated Power Range Price Range

Muye S500 22/26 140 50-12000 1:10 1.8-2.2 million

DMG DMU50 27/34 170 30-12000 1:8 1.6-1.9 million

HAS VF4 22/26 122 50-7500 1:5 800,000-950,000

2.3 Thermal Stability Engineering

Temperature Control Strategy:

Constant temperature of key components: forced cooling of the spindle, lead screw, and bearings

Thermosymmetric design: Reducing non-uniform thermal deformation

Environmental Adaptation: Equipped with a temperature sensor for automatic compensation

Thermal drift index:

Accuracy variation during 4-hour continuous operation: Precision machine tools ≤ 0.008 mm

Poor precision of cooling and heating units: High-quality machine tools ≤0.005mm

Ambient temperature compensation: Automatic compensation within the range of 5 to 35°C

Part Three: Control Systems and Intelligent Functions

3.1 Comparison of Mainstream Control Systems

Three major system camps:

Siemens SINUMERIK (Germany):

Market share: Approximately 35% in the global high-end market

Strengths: 5-axis machining, lathe and milling combined machining, digital integration

Representative models: 840D sl (high-end), 828D (mid-range)

Intelligent functions: adaptive control, process cycle management, digital twin compatibility

FANUC (Japan):

Market share: Approximately 45% in the global mid-to-high-end market

Strengths: High stability, excellent usability, comprehensive ecosystem

Representative models: 31i-B5 (high-end), 0i-F (mid-range)

Intelligent Functions: AI Thermal Compensation, AI Contour Control, Servo Optimisation

HEIDENHAIN (Germany):

Market share: Approximately 251 TP3T in the European premium market

Advantages: Superior human-machine interaction, high-precision control

Representative models: TNC7 (high-end), iTNC530 (mid-range)

Intelligent functions: Dynamic optimisation, collision prevention, intelligent tool management

Progress in Domestic Control Systems:

Huazhong CNC: Approximately 151 TP3T units in the domestic market, offering excellent value for money.

Guangzhou CNC: Mainstay of the Economy-Class Market, Enhanced Stability

Technological gap: A 5- to 8-year disparity persists in 5-axis simultaneous control and high-speed, high-precision control.

3.2 Substantive Evaluation of the Value of Intelligent Functions

Adaptive control function:

Load Adaptation: Adjusts feed rate according to cutting force. Typical effect: Tool life extended by 30–50%.

Vibration Suppression: Enhances surface quality through active flutter control.

Thermal compensation: Real-time compensation based on models and sensors

Predictive Maintenance System:

Spindle Health Monitoring: Bearing Condition Analysis and Pre-emptive Warning

Ball Screw Wear Prediction: Life Calculation Based on Load and Stroke

Tool monitoring: Multidimensional monitoring via load and acoustic emissions

Digital integration capability:

OPC UA Interface: Enabling data exchange with MES/ERP systems

Remote Diagnosis: Manufacturer Remote Service Support

Data collection: Automatic recording of production data and quality data

Return on Investment Analysis:

Basic Smart Package: Investment amount of 8-151 million yuan, payback period of 1.5-2 years

High-Level Intelligent Package: Additional investment amount 15-25%, payback period 2-3 years

Long-term value: Reducing reliance on operator experience and enhancing consistency

Part IV: Reliability, Conservatism and Service Support

4.1 Quantification of Reliability Metrics

Mean Time Between Failures (MTBF):

Industry benchmark: ≥2000 hours

Standard Level: 1200–1800 hours

Testing Method: The manufacturer shall provide a third-party verification report.

First overhaul period:

First overhaul of the spindle: ≥20,000 hours (high-quality brand)

Replacement cycle for guide rails and ball screws: ≥50,000 hours

Overall overhaul interval: ≥60,000 hours

Actual user data survey (based on feedback from 300 companies):

German brands: average annual breakdown rate of 1.2 times, average repair time of 3.5 days

Japanese brands: Annual average number of faults: 1.5 times; average repair time: 2.8 days

Taiwanese brands: Annual average number of faults: 2.3; average repair time: 4.2 days

Leading domestic brand: Annual average number of faults: 2.8 incidents; Average repair time: 5.5 days

4.2 Design for Maintainability

Conservative evaluation factors:

Protective design: Guiding rail and ball screw protective effect

Accessibility: Ease of replacing major components

Modular design: module replacement rather than repair

Diagnostic Assistance: Maintenance Guidance via Smart Diagnostic System

Conservative cost estimate:

Annual preventive maintenance costs: 1.5–31% of equipment value

Parts cost comparison: German-brand parts are typically 30–50% more expensive than Japanese-brand parts.

Downtime cost: RMB 2,000–8,000 per hour on average (based on equipment value)

4.3 Evaluation of the Service Support System

Manufacturer Service Capability Metrics:

Response time: In the event of an emergency fault, on-site assistance within four hours.

Engineer Level: Proportion of Certified Engineers ≥70% TP3T

Spare Parts Inventory: On-site stock availability rate for commonly used spare parts ≥85% TP3T

Training System: Systematised operational, programming, and maintenance training

Third-party service market:

Independent service providers: Costs are 30–50% lower than genuine parts, but quality varies.

Remanufacturing Market: Enhancing the performance of older equipment at 40-60% of the cost of new units.

Part V: Total Cost of Ownership and Return on Investment Analysis

5.1 Breakdown of Initial Investment Costs

Standard configuration price range (three-axis vertical machining centre, table 800×500mm):

Ultra-premium (Germany/Switzerland): ¥1.8–3 million

High-end (Japan): ¥1.2–1.8 million

Mid-to-high range (Taiwan): NT$700,000–1,200,000

Economy Class (Top Domestic Class): ¥400,000–700,000

Entry-level model (domestic second brand): ¥200,000–400,000

Identification of hidden costs:

Down payment and adjustment: 2–51% of equipment price

Basic modifications: bed load capacity, electrical power, compressed air, etc.

Initial spare parts: Stockpiling of commonly used spare parts is recommended, equivalent to 3–5% of the equipment price.

Training fees: Operational and programming training

5.2 Operational Cost Analysis

Energy consumption costs:

Standby power consumption: 2–5 kW

Processing energy consumption: Spindle output × Load factor × Electricity tariff

Energy consumption of the auxiliary system: cooling, lubrication, chip removal, etc.

Comparative example: The annual energy consumption difference for identical equipment ranges from 15 to 251 terawatt-hours.

Tools and Consumables:

Cutting fluid: Annual consumption of 3,000 to 8,000 yuan per machine

Filters etc.: Annual expenditure of 2,000–5,000 yuan

Lubricating oil/grease: Annual consumption 1,000–3,000 yuan

Personnel costs:

Operator requirements: High-end equipment necessitates operators possessing more advanced skills, with salaries being 20-40% higher.

Programmer: Complex equipment requires a specialist programmer.

5.3 Production Capacity and Return on Investment

Production Capacity Comparison Model (Taking Aluminium Alloy Component Processing as an Example):

Brand Level Average Cutting Speed Tool Change Time Positioning Time Theoretical Productivity Index

Ultra-high-end 1.0 (reference) 1.2 seconds 0.8 seconds 100

High-end 0.85 1.5 seconds 1.0 seconds 82

Mid-to-high level 0.70 2.0 seconds 1.5 seconds 68

Economy Type 0.60 2.5 seconds 2.0 seconds 55

Calculation of the Return on Investment:

Simple payback period = Total investment ÷ Annual net profit increase

Discounted payback period: Taking into account the time value of money

Example: A company purchased a German-made machine tool for ¥1.6 million versus a Japanese-made machine tool for ¥950,000.

German model: Annual profit increase of 650,000, payback period of 2.5 years

Japanese model: Annual profit increase of ¥480,000; payback period of 2.0 years

Taking all factors into consideration: opting for Japanese-affiliated companies yields greater capital efficiency.

Part Six: Comprehensive Comparison of Major Brands and Selection Strategy

6.1 Brand Hierarchy Analysis

First Wave: Technical Leader

Representative brands: DMG MORI, GROB, MAKINO

Core strengths: Total solutions, complex process capabilities, digital integration

Price range: 1.5 to 5 million yuan and above

Target users: Aerospace, precision moulds, high-end automotive components

Second tier: Those with well-balanced performance

Representative brands: MAZAK, OKUMA, HAAS

Core strengths: High reliability, excellent cost performance, global service network

Price range: ¥800,000 to ¥2,000,000

Target users: General machinery, automotive components, medical equipment

Third wave: Value providers

Representative brands: Yeong Jin, Tongtai, FFG

Core strengths: Flexible configuration, price competitiveness, prompt delivery

Price range: ¥500,000–1,200,000

Target users: Mass production and customised modifications for small and medium-sized enterprises

Fourth tier: Economical and practical models

Representative brands: Haitian Precision Machinery, Neway CNC, Shenyang Machine Tool

Core strengths: Localised services, price competitiveness, fulfilment of basic needs

Price range: ¥250,000–800,000

Target users: Start-up companies, educational institutions, simple component machining

6.2 Special Considerations for Five-Axis Machine Tools

Comparison of Five-Axis Machining Technologies:

Dual turntable type: The workbench rotates, making it suitable for small components.

Pendulum type: A mechanism where the spindle oscillates, suitable for large components.

Hybrid system: turntable plus tilt head, offering the highest level of flexibility

Challenges in maintaining precision:

Deterioration in rotary axis accuracy: Requires recalibration every two years, with costs amounting to approximately ¥10,000–30,000.

Dynamic accuracy: Actual contour accuracy during 5-axis simultaneous machining

Test standard: VDI/DGQ 3441, ISO 10791-7

Brand Comparison:

German brands: The average 5-axis synchronisation precision leads Japanese brands by 30%.

Price difference: For 5-axis machining centres with equivalent specifications, German-made models are 40 to 60% more expensive than Japanese-made ones.

6.3 Dedicated Machine Tools and Production Lines

Multi-spindle machine tools:

Application scenario: Mass production of symmetrical components

Efficiency improvement: 2 to 4 times compared to a single spindle

Investment risk: Low adaptability to product changes

Multi-tasking machine:

Technical Difficulty: B-axis precision, synchronous control, programming complexity

Return on investment: Reduction in capital expenditure, enhanced precision, and shortened lead times

Principal brands: INDEX, WFL, TSUGAMI

Part Seven: Procurement Decision-Making Processes and Negotiation Strategies

7.1 Systematised procurement process

Phase One: Requirements Analysis and Specification Development (2–4 weeks)

Current and Future Component Analysis: Materials, Dimensions, Precision, Lot Sizes

Processing Capability Requirements: Maximum Cutting Force, Rotational Speed Range, Number of Interconnected Axes

Production capacity requirements must be calculated based on business projections for the next three to five years.

Budget formulation: from the perspective of total cost of ownership, not merely the purchase price

Stage Two: Supplier Selection and Evaluation (3–6 weeks)

Select 5 to 8 suppliers: covering different tiers

Technical Evaluation: On-site inspection, prototype sample cutting test, technical Q&A session

Business Evaluation: Price, Delivery Time, Payment Terms, Service Conditions

User research: Visit 3–5 existing users (prioritising competitors within the same industry)

Stage Three: Detailed Negotiations and Contract Execution (2–4 weeks)

Technical Agreement: Defined Acceptance Criteria, Performance Guarantee Values

Business Contract: Payment Terms, Liability for Breach, Confidentiality Clauses

Service Agreement: Response Times, Scope of Coverage, Training Content

Spare Parts List: Recommended Stock Levels and Price Fixing

7.2 Key Negotiation Points and Techniques

Price Negotiation Strategy:

Obtaining multiple quotations: creating a competitive environment

Itemised quotations: Request detailed item-by-item estimates to identify inflated costs.

Bundle purchase: Negotiating discounts for multiple units (typically 5–15 units)

Off-season purchases: Additional discounts may be available at year-end or quarter-end.

Negotiation of technical terms:

Inspection Criteria: Specifying Test Methods, Conditions, and Acceptance Criteria

Performance guarantee: Requiring written confirmation and linking it to payment

Upgrade Path: Fixed pricing for future feature upgrades

Training Programme: Defined duration, content, and number of participants

Optimisation of Terms of Service:

Warranty period extension: Aiming for 24 to 36 months (standard 12 months)

Response time: A clearly stipulated time commitment as specified in the contract

Spare Parts Pricing: Fixed pricing for key spare parts over the next three years

Software Updates: Free Update Period and Subsequent Costs

7.3 Risk Mitigation Measures

Technical risk:

Cutting tests on prototype components: Our representative components must undergo actual machining.

Partial payment: Retain at least 10-20% of the final payment amount, to be settled after inspection and acceptance.

Performance bond: A performance bond of 5 to 10% of the contract value is required.

Extradition risk:

Penalty for Late Delivery: Daily Penalty (Typically 0.05–0.11% of the Contract Amount)

Acceptance deadline: Completion of acceptance within a reasonable period following delivery.

Domestic stock: Prioritise models with domestic stock availability

Long-term risk:

Technological obsolescence: Taking into account technological trends over the next three to five years

Supplier stability: Assessment of manufacturers' financial standing

Exit costs: ease of equipment disposal and residual value

Conclusion: Rational decision-making, strategic investment

The acquisition of CNC machine tools represents one of the most significant capital investments for enterprises, with the quality of this decision directly impacting manufacturing capacity and market competitiveness for years to come. Through systematic evaluation and rational selection, companies can maximise the value of their investment.

Specific proposals for different companies:

Start-up companies / Small-batch, multi-variety production:

Priorities: Flexibility, ease of use, low initial investment

Recommended configuration: Taiwanese brand or top domestic brand, 3-axis machining centre

Investment budget: Allocate 20-30% of the equipment value to peripheral equipment such as jigs and tools.

Growth enterprises / Medium-scale production:

Priorities: Reliability, Production Efficiency, Scalability

Recommended configuration: Japanese mid-range brands, with basic automation options supported

Key initiatives: Enhancing equipment utilisation rates and rapid mould change capabilities

Mature enterprises / Mass production:

Priorities: Overall efficiency, automation integration, quality consistency

Recommended configuration: Dedicated high-end brand equipment or flexible manufacturing unit

Strategic considerations: Establish strategic partnerships with suppliers and participate in equipment customisation.

Technology-driven enterprises:

Priorities: Technological sophistication, complex process capabilities, digitalisation level

Recommended configuration: German premium brand, 5-axis or lathe-milling combination machine

Direction of innovation: Collaborate with manufacturers to develop new processes and establish technological barriers.

Regardless of a company's size, remember this golden rule: optimal is best. Rather than blindly pursuing the highest precision or fastest speed, machine tool capabilities should be aligned with your product requirements, process characteristics, and employee skills.

Amidst the tide of digital transformation, modern machine tools serve not merely as processing equipment but also function as data nodes and intelligent terminals. Selecting equipment equipped with open data interfaces and supporting digital integration lays the foundation for enterprises' future smart manufacturing strategies.

Finally, we propose establishing a long-term mechanism for equipment procurement: formulating a three- to five-year capital expenditure plan, establishing a standardised procurement evaluation process, and cultivating an in-house team of equipment assessment specialists. By accumulating experience and optimising benchmarks through each procurement cycle, we can transform capital expenditure decision-making from isolated transactions into a process that continuously builds the company's core competitiveness.

No comments